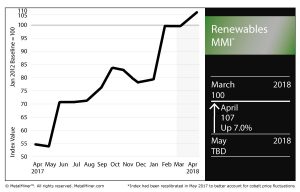

The Renewables Monthly Metals Index (MMI) rose seven points on the month, hitting 107 for our April reading.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Within the basket of metals, Korean, Chinese and U.S. steel plate posted price increases, while Japanese steel plate traced back slightly. U.S. steel plate jumped significantly, posting a 13.6% increase for the month.

U.S. grain-oriented electrical steel (GOES) coil fell on the month, while neodymium picked up by 0.7%.

The always volatile cobalt price shot up significantly last month, rising 10.6%.

Tesla Strategy Places Premium on Neodymium

As we mentioned earlier this week, growing demand for neodymium from electric vehicle (EV) maker Tesla will put even more pressure on what is already a constrained market.

In short, that means rising prices for the material, reflected in this month’s activity.

Tesla is looking to neodymium for magnetic motors in its Model 3 Long Range cars, as mentioned in the Reuters report we cited Tuesday. Last year, supply fell short of demand by 3,300 tons, according to that report.

DRC Looks to Shake Up 2002 Mining Charter

When it comes to anything cobalt, the Democratic Republic of Congo is typically at the center, being the source of the majority of the world’s cobalt.

Earlier this week, MetalMiner’s Stuart Burns wrote about President Joseph Kabila’s move to readjust the nation’s 2002 mining charter to, essentially, secure a bigger piece of the pie vis-a-vis the country’s vast mineral resources.

It comes as no surprise that the multinational miners doing business in the DRC aren’t exactly thrilled by the proposition of increased royalties and levies. However, as Burns noted, value of materials like cobalt and the demand they draw, combined with their relative scarcity, means such multinationals will continue to do business there, no matter what happens with the charter.

“If the state takes a little more of the pie, it will probably be reflected in prices,” Burns wrote. “But with limited alternatives for products like cobalt, it is unlikely to dent mining companies’ enthusiasm for investing in the DRC.”

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel