LME nickel prices hit $13,200 per ton last Wednesday, the highest level since June 2015 before investors took profits and the price fell back a touch to $12,870 per metric ton. Prices were led higher by the ShFE, where stock have fallen to 48,920 tons from over 90,000 tons just a year ago — and […]

Tag: L9

The Crude Oil Price Continues Upward March Amid Political Turmoil, Demand Growth

Amongst a plethora of news, comment and opinion, it is often like struggling through a jungle when trying to get clarity on the commodities landscape. Sometimes, there is almost too much information. Two-Month Trial: Metal Buying Outlook So, an analysis in the Financial Times entitled “Five things to watch as Brent crude oil nears $70” […]

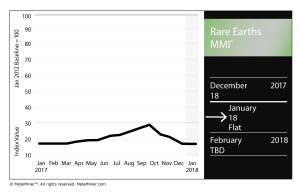

Rare Earths MMI: Global Market Projected to Hit $20 Billion by 2024

The Rare Earths Monthly Metals Index (MMI) held flat for the month, posting a value of 18 for our January reading.

Reflecting the lack of movement in the MMI value, the basket of metals posted modest price fluctuations.

Two-Month Trial: Metal Buying Outlook

Chinese yttrium rose 1.9%, while terbium oxide dropped 0.8%. Neodymium oxide fell 1.3% on the month.

Australian Miner Receives State’s EPA Approval

A $900 million Australian miner received approval from the state’s Environmental Protection Authority (EPA), mining.com reported.

According to the report, Arafura Resources received approval on Friday after a two-year process. The EPA had been considering the environmental impacts of the Nolans rare earths project, the website reported, concluding that those risks at the site could be managed.

According to the report, Arafura estimates the project would create an investment of about $900 million in central Australia.

Global Market to Reach $20 Billion by 2024

The global rare earths market is projected to hit a value of $20 billion by 2024, according to a research report by Global Market Insights, Inc.

“Growing demand for magnets in automobiles, and energy generation will majorly contribute to the growth of global rare earth metals market over the forecast period,” the Globe Newswire release states. “The demand for rare earth magnets is majorly increasing by their consumption in electric and hybrid vehicles, and wind turbines. Increasing focus on utilizing clean and renewable energy is giving a substantial pressure on the electricity providers, to generate energy through renewable sources, which in turn will show a positive impact on the growth of this market.”

Not surprisingly given China’s overwhelming dominance of the rare earths markets, prices will continue to fluctuate somewhat wildly based on Chinese supply.

As for individual metals, neodymium will continue on in its place at or near the top of the rare-earths heap.

“By revenue, neodymium had the highest market share in 2016, with a market share of over 30%,” the release states. “It will dominate the global rare earth metals market till the end of projected period. Neodymium market will grow at a CAGR of 8.2% from 2017 to 2024.”

Free Sample Report: Our Annual Metal Buying Outlook

Actual Metal Prices and Trends

GOES MMI: GOES M3 Prices Rise with Other Forms of Steel

Grain-oriented electrical steel (GOES) prices do not often follow the pattern of price increases for other forms of steel. However, December’s data suggests otherwise. GOES prices increased along with HRC, CRC, plate and HDG. In addition to prices moving in a similar direction, import levels also followed similar patterns, although GOES imports showed a dramatically […]

Trump Looks to Open Up Continental Shelf to Oil Exploration

President Trump is not unused to controversy — some say he even courts it. So, a recent proposal following an executive order signed last April to widen energy exploration should come as no surprise. The draft Five-year Outer Continental Shelf Oil and Gas Leasing Program has been enthusiastically welcomed by the oil and gas industry […]

Aluminum MMI: Prices Rise and Trading Volumes Have Strong Showing

After last month’s drop, the Aluminum MMI (Monthly Metals Index) index increased by three points. The current Aluminum MMI index reads 98 points, 3.2% higher than the December reading.

Benchmark Your Current Metal Price by Grade, Shape and Alloy: See How it Stacks Up

In December, MetalMiner anticipated a rise in aluminum prices … and that is exactly what happened.

Aluminum prices increased by 10.6% in December, reaching a more than two-year high.

[caption id="attachment_89629" align="aligncenter" width="580"]

Trading volumes appear strong and accompany the current uptrend. Moreover, aluminum’s latest peak has climbed over previous ones, signaling strength in its latest market rally. Other macroeconomic indicators, such as a weaker U.S. dollar and a stronger CRB index driven by higher oil prices, may continue to support aluminum prices.

Moreover, the Department of Commerce’s Section 232 investigation should see a report released mid-January, which will also impact prices. The U.S. Department of Commerce announced a new self-initiated anti-dumping and countervailing duty investigation on imports of Chinese common aluminum alloy sheet at the end of November. The U.S. has launched several anti-dumping campaigns for aluminum products this past year.

Crude Oil

As oil prices serve as a critical part of the CRB index, together with other base metals, buying organizations need to monitor oil price trends.

Moreover, there are some base metals, such as aluminum, that are strongly influenced by oil prices.

[caption id="attachment_89630" align="aligncenter" width="580"]

Oil prices have increased again this month. Current oil prices remain above our bullish level signal, meaning that we could expect some more upward movement for oil.

Similarly, increasing oil prices will continue to provide support to base metals prices.

Aluminum Scrap

Chinese aluminum scrap prices increased sharply this month and appear in a long-term uptrend since 2016.

The latest rally in both LME and SHFE aluminum prices also results in a jump in aluminum scrap prices. Chinese scrap prices increased by 4.9% this month.

[caption id="attachment_89631" align="aligncenter" width="580"]

What This Means for Industrial Buyers

Aluminum prices jumped sharply again this month. After sharp price increases, base metal prices sometimes pull back to digest the previous gains. Aluminum prices may lack some price momentum this month, although that continues signaling bullishness for the light metal.

Therefore, adapting the “right” buying strategy becomes crucial to reduce risks by knowing when to buy.

Free Sample Report: Our Annual Metal Buying Outlook

Actual Aluminum Prices and Trends

Does Gold’s Rise Have Anything to do with Bitcoin?

Gold has defied interest rate rises and record equity markets to rally to its highest level in more than three months, the Financial Times reported this week. Rising more than 6% since early December to over $1,300/ounce — its highest level, the paper reports, since September 2015. Gold is normally considered a safe-haven asset and a […]

Automotive MMI: HDG Steel, LME Copper Post Big Price Increases

The Automotive MMI posted no movement for our January reading, sticking at 97 after a four-point jump from November to December.

Benchmark Your Current Metal Price by Grade, Shape and Alloy: See How it Stacks Up

The January MMI reading — which tracks the sector’s December performance — has risen significantly in the last 12 months. The sub-index posted an 82 for its January 2017 reading.

Within the basket of metals, U.S. HDG steel and LME copper had big months. For the former, the metal rose 5.5% during the period in question, while Dr. Copper jumped 6.4%.

U.S. Auto Sales

It was a down month for General Motors, which saw its sales drop 3.4% year-over-year in December 2017, with 308,112 units sold, according to sales data released Jan. 3 by Autodata Corp. GM thus closed the year with sales dropping 1.4% from its 2016 total.

Ford, meanwhile, saw its December sales rise 1.3% year-over-year, with 240,910 units sold in the month. As for the year-end numbers, Ford’s sales drop was less than GM’s, with a 0.9% dip compared to 2016 sales for the company.

Further down the sales list, Fiat Chrysler‘s December sales dropped 10.7% year-over-year and were down 8.2% for the year.

Fiat Chrysler wasn’t the only one to have a rough month. Toyota‘s December sales were down 8.3% year-over-year, while Honda‘s (7.0%) and Nissan‘s (9.5%) were also down.

Volkswagen dropped 5.4% in December compared with December 2016, but came out ahead in 2017, with sales rising 6.1% at year’s end compared with the previous year.

While Mitsubishi‘s absolute sales don’t come in near the top of the list, it had a good year in the U.S. market, selling 103,686 units in 2017 — up 7.7% from 2016 sales. In December, Mitsubishi’s sales rose 15.1% compared with December 2016.

Record Sales in 2017 for Tesla, But Struggles with Deliveries

Meanwhile, Tesla’s year was a two-sided tale.

As Business Insider UK reported, the electric vehicle (EV) maker hit record sales in 2017, but struggled with deliveries of its new Model 3.

The challenge for Tesla, of course, is transforming from a still relatively niche brand — catering to those who check the boxes of environmental mindfulness and being financially well off — to a mainstream automotive manufacturer capable of meeting demand with consistency.

It’s still unclear whether Tesla can do that, but EVs aren’t going away either way. Of course, Tesla isn’t the only player in the game, and competition in the EVs sector will only continue to grow in 2018 and beyond.

Eyes on China

A big year is ahead for automotive sales in China.

And it’s not just about this year — according to William C. Ford Jr., executive chairman of Ford, the future of EVs will be led by China.

“When I think of where E.V.s are going, it’s clearly the case that China will lead the world in E.V. development,” he told The New York Times.

Speaking of Ford, last month the automaker announced plans to collaborate with e-commerce conglomerate Alibaba.

“Under the three-year agreement, both companies will jointly explore areas of cooperation that are re-shaping the automotive industry in China and around the world,” a Dec. 7 Ford news release states. “Ford will cooperate with Alibaba’s four business units in operation system, cloud computing, digital marketing and online retail respectively – namely AliOS, Alibaba Cloud, Alimama and Tmall – and jointly explore a variety of areas of cooperation including mobility services, connectivity, cloud computing, artificial intelligence and digital marketing.”

Ford President and CEO Jim Hackett also underscored the importance of China.

“China is one of the world’s largest and most dynamic digital markets, thriving on innovation with customers’ online and offline experiences converging rapidly,” he said in the release. “Collaborating with leading technology players builds on our vision for smart vehicles in a smart world to reimagine and revolutionize consumers’ mobility experiences.”

Free Sample Report: Our Annual Metal Buying Outlook

Actual Metal Prices and Trends

Sign up or sign in to grab exact prices!

Tata Steel Looks to Build on Solid 2017 Performance

Tata Steel has a couple of things going for it in the new year — but before we get into that, 2017 was a bit kinder to it than the preceding two years. And we are not saying that, but the CEO and MD of Tata Steel, T.V. Narendran himself, told a gathering of employees […]