The Automotive Monthly Metals Index (MMI) picked up two points this month, rising for a reading of 104. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook U.S. Auto Sales Sales in the U.S. bounced back in May after a slower April. According to the New York Times, May auto sales jumped 2%, driven […]

Category: Automotive

This Morning in Metals: U.S. Launches Section 232 on Auto Imports

This morning in metals news, the U.S. this week announced a new Section 232 probe investigating automotive imports, the specter of auto tariffs looms over Europe and Asia, and Mexico’s economy minister opines on the chances of a deal on the North American Free Trade Agreement (NAFTA) before the July Mexican presidential election. Need buying […]

Europe Has the Potential to Develop Domestic Lithium Sources

We normally associate Cornwall in England with scones and cream teas … or, if we are really metal nerds, we associate the sometimes sunny southeast country of the British Isles with mining (particularly with tin mining). Need buying strategies for steel? Try two free months of MetalMiner’s Outlook The area dominated with igneous morphology has […]

Week in Review: Section 232, Nickel Fundamentals and a Brexit Check-In

Before we head into the weekend, let’s take a look back at the week that was. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook But first, if you plan on partaking in Cinco de Mayo celebrations tomorrow, you might want to check out our post from 2016 about stainless steel and […]

Automotive MMI: U.S. Auto Sales Drop in April

The Automotive Monthly Metals Index (MMI) tracked back slightly this past month, losing one point to fall to a reading of 102 for our May MMI, as U.S. auto sales dropped in April. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Within the basket of metals, U.S. HDG got a slight boost, as […]

USITC to Advise USTR on Proposed KORUS Changes Related to Auto Duties

The U.S. International Trade Commission late last week sent out a note that it is looking for input on a new investigation concerning proposed modifications to the U.S. Korea Free Trade Agreement (KORUS), specifically related to customs duties for motor vehicles. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Recently, the […]

Week in Review: DRC Mining Charter, Hong Kong Housing and MMI Week

Before we head into the weekend, let’s take a look back at the week that was and some of the stories here on MetalMiner: Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Joseph Kabila, president of the Democratic Republic of Congo, is looking to rip up a 2002 mining charter in […]

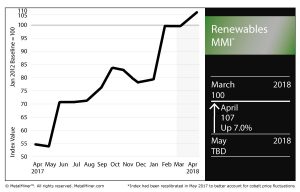

Renewables MMI: Cobalt, U.S. Steel Plate Post Big Price Jumps

The Renewables Monthly Metals Index (MMI) rose seven points on the month, hitting 107 for our April reading.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Within the basket of metals, Korean, Chinese and U.S. steel plate posted price increases, while Japanese steel plate traced back slightly. U.S. steel plate jumped significantly, posting a 13.6% increase for the month.

U.S. grain-oriented electrical steel (GOES) coil fell on the month, while neodymium picked up by 0.7%.

The always volatile cobalt price shot up significantly last month, rising 10.6%.

Tesla Strategy Places Premium on Neodymium

As we mentioned earlier this week, growing demand for neodymium from electric vehicle (EV) maker Tesla will put even more pressure on what is already a constrained market.

In short, that means rising prices for the material, reflected in this month’s activity.

Tesla is looking to neodymium for magnetic motors in its Model 3 Long Range cars, as mentioned in the Reuters report we cited Tuesday. Last year, supply fell short of demand by 3,300 tons, according to that report.

DRC Looks to Shake Up 2002 Mining Charter

When it comes to anything cobalt, the Democratic Republic of Congo is typically at the center, being the source of the majority of the world’s cobalt.

Earlier this week, MetalMiner’s Stuart Burns wrote about President Joseph Kabila’s move to readjust the nation’s 2002 mining charter to, essentially, secure a bigger piece of the pie vis-a-vis the country’s vast mineral resources.

It comes as no surprise that the multinational miners doing business in the DRC aren’t exactly thrilled by the proposition of increased royalties and levies. However, as Burns noted, value of materials like cobalt and the demand they draw, combined with their relative scarcity, means such multinationals will continue to do business there, no matter what happens with the charter.

“If the state takes a little more of the pie, it will probably be reflected in prices,” Burns wrote. “But with limited alternatives for products like cobalt, it is unlikely to dent mining companies’ enthusiasm for investing in the DRC.”

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Metal Prices and Trends

Automotive MMI: U.S. Auto Sales Rev Up for 6.3% Year-Over-Year Jump in March

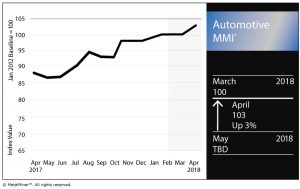

The Automotive Monthly Metals Index (MMI) jumped three points for an April reading of 103 after a month that saw the U.S. impose Section 232 tariffs of 25% and 10% on steel and aluminum imports, respectively, in addition to escalating trade tensions between the U.S. and China.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

U.S. shredded scrap jumped 3.1%, while LME copper continued its 2018 cooling down, dropping 2.5% month over month.

Chinese primary lead jumped 1.3%.

U.S. Auto Sales

According to monthly sales data release by Autodata Corp, it was a strong month for several of the top automakers in the U.S. market.

General Motors posted a 15.7% increase in sales year over year, and is up 3.8% in the year to date compared with the same time frame last year.

Ford Motor Co. saw its sales jump 3.5% year over year in March, but remains down 2.7% in the year to date.

Fiat Chrysler’s March sales jumped 13.6% year over year, and boasts an 0.8% increase for the year to date. Toyota’s sales jumped 3.5% in March year over year and is up 7.4% in the year to date. Honda also had a good month, posting a year-over-year sales increase of 3.8%; however, its year-to-date sales are down 0.8%.

Volkswagen, Mitsubishi and Mazda continued what has been a strong 2018 for each of them. Volkswagen’s March sales rose 13.5% year over year, while the German automaker’s year-to-date sales are up 9.9%. Mitsubishi jumped 21.7% in March and is up 22.7% in the year to date. Mazda, meanwhile, posted a 35.7% increase in March and is up 21.6% in the year to date.

In total, vehicle sales in March were up 6.3% year over year and are up 1.9% in the year to date. American consumers continue to prize light trucks, as sales of those vehicles rose 16.3% year over year in March and are up 9.8% for the year to date.

U.S.-China Trade Tensions Rise

Earlier this week, the Office of the United States Trade Representative released a list of 1,300 Chinese products that could be hit with tariffs (stemming from the administration’s Section 301 probe of Chinese trade practices).

Not long after, China announced it would place 25% tariffs on 106 U.S. products, including autos, Reuters reported.

Tesla and Tariffs

It’s been a rough couple of weeks for Tesla.

In late March, the fatal crash of a Tesla Inc. Model X led to a massive selloff, leading to an 8.2% drop in its stock and its lowest closing in almost a year, CNBC reported.

On top of that, the electric vehicle (EV) maker continues to struggle with the cold, hard reality of production timelines. CNBC reported that Tesla missed its quarterly goal of producing 2,500 Model 3s per week.

The stock price recovered Tuesday, but Wednesday’s news of $50 billion in tariffs from China — in retaliation to the U.S.’s own recent announcement regarding a potential $50 billion in tariffs on Chinese imports — is another hit to the EV firm.

According to Bloomberg, China accounted for 17% of Tesla’s 2017 revenue.

Actual Metal Prices and Trends

A Battle Rages Between Two Rival London Black Cab Manufacturers

The fight is on in the streets of London between two rival manufacturers of the iconic London black cab. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Earlier this year the London High Court cleared an appeal made by the Chinese-owned London Electric Vehicle Company (LEVC) against British Metrocab that had […]