The Renewables Monthly Metals Index (MMI) picked up a point this month, rising for an MMI reading of 102. Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook DRC Declares Cobalt ‘Strategic’ Substance The Democratic Republic of the Congo (DRC) — where a majority of the world’s cobalt is mined — declared […]

Category: Minor Metals

Week in Review: MMI Week, Tariff Waivers and Russian Sanctions

Before we head into the weekend, let’s take a look back at the week that was and some of the metals storylines here on MetalMiner: Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook We kicked off our November MMI this week. In case you missed it, revisit our subindex recaps […]

Rare Earths MMI: China Denies Reports of Rare Earth Output Cuts

The Rare Earths Monthly Metals Index (MMI) held flat this month, again hitting an MMI reading of 17. Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook China Denies Report it is Limiting Rare Earth Output China’s dominance in the rare earths sector is well-documented. The country’s sway in the market is […]

Rare Earths MMI: U.S. Drops Rare Earths From $200B Tariff List

The Rare Earths Monthly Metals Index (MMI) stood pat this month for an MMI value of 17. Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook Pentagon Reviews Critical Materials Dependence Tariffs have been flying left and right this year, impacting a wide range of products, from steel and aluminum to […]

Indian Exporters of Rare Earths Protest Government’s Export Prohibition

Rare earth exporters in India have lodged protests after the government snatched their rights to send these precious elements abroad. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Rare-earth metals are a group of 17 elements, which are found in geological deposits. Some of the most abundant metals in the world […]

Rare Earths MMI: Rare Earths Appear on Trump Administration’s Proposed $200B Tariff List

The Rare Earths Monthly Metals Index (MMI) fell one point for an August reading of 18. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Rare Earths and Trade Tensions Much has been said about the rise of trade tensions around the world, particularly between the U.S. and China. Those tensions began to manifest […]

Week in Review: Auto Hearings, Wind Energy, Cobalt and a Uranium Investigation

Before we head into the weekend, let’s take a look back at the week that was and some of the metals storylines here on MetalMiner®: Need buying strategies for steel? Try two free months of MetalMiner’s Outlook India sought consultations with the U.S. over its steel and aluminum tariffs. The Department of Commerce launched anti-dumping […]

Concentration of Cobalt Sector Expected to Increase in Coming Years

Cobalt is a product we don’t often talk about, partly because of its relative scarcity but also because of the specificity of its industrial application. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook With that said, the industries it does draw interest from are high-profile ones, including the growing electric vehicle […]

Rare Earths MMI: Toyota, Other Firms Team Up With Scientists to Develop Undersea Rare Earths Extraction Technology

The Rare Earths Monthly Metals Index (MMI) stood pat this month, holding for a reading of 19. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook The Search for Rare Earths As we noted in an MMI post earlier this year, the discovery of a large deposit of undersea rare earths approximately […]

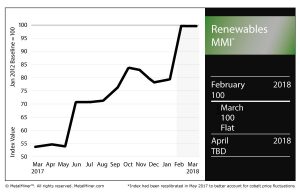

Renewables MMI: U.S. Steel Plate Surges, Cobalt Could be Getting Costlier

[caption id="attachment_88708" align="alignleft" width="300"]

The Renewables MMI (Monthly Metals Index), after a significant surge last month, sat at 100 for the second consecutive month.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Within this basket of metals, the Japanese steel plate price rose, as did the price of Chinese and American steel plate. U.S. steel plate, in fact, rose 5.5% month over month.

U.S. grain-oriented electrical steel (GOES) coil also jumped in price.

As for the trio of rare and minor metals in this MMI, cobalt cathodes fell 1.1%, while silicon dropped slightly and neodymium made a small gain.

Cobalt Costs

According to a report by the Financial Times, changes to the mining code in the Democratic Republic of Congo will lead to higher costs for consumers of the metal.

According to the report, President Joseph Kabila on Wednesday said he would sign a new order after meeting with representatives from some of the big miners with business in the country, including Glencore, Molybdenum and Ivanhoe Mines.

Cobalt is used in batteries for electric vehicles (EVs), among other things, making it an especially prized material as EVs gain popularity. As such, with a majority of the world’s cobalt being mined in the DRC, political machinations in the country have a significant impact on the metal’s price.

According to the Financial Times, the code could see royalties on cobalt — plus other metals, like copper and gold — rise from 2% to 10%.

Senators Lobby for Electrical Steel Protection in 232

The Journal-News reported on a trio of U.S. senators who lobbied Trump to prioritize electrical steel in the Section 232 trade remedy process.

The only remaining maker of electrical steel in the country, AK Steel, was unlikely to benefit from the Section 232 trade remedy proposal, according to Sen. Rob Portman (R-OH).

In the senators’ letter, they requested the president add a trio of HTS codes to the duty order.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel