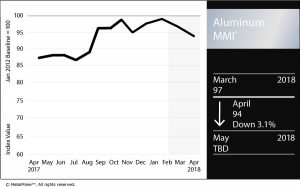

The April Aluminum MMI (Monthly Metals Index) fell three points. A weaker LME aluminum price led to the price retracement. The current Aluminum MMI index stands at 94 points, 3% lower than in March.

LME aluminum price momentum slowed again this month. LME aluminum prices remain in a current two-month downtrend.

Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook

[caption id="attachment_91252" align="aligncenter" width="580"] Source: MetalMiner analysis of FastMarkets[/caption]

Source: MetalMiner analysis of FastMarkets[/caption]

Though some may want to declare a bearish market for aluminum, prices are still over the $1,975 level, when MetalMiner recommended buying organizations buy forward. Prices may retrace back toward that level. However, if prices fall below the blue-dotted line, aluminum prices could shift toward bearish territory.

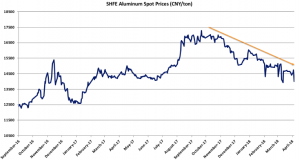

SHFE Aluminum

SHFE aluminum spot prices also fell this month. The degree of the decline appears less sharp than for LME prices. However, SHFE aluminum spot prices started to fall in October 2017.

[caption id="attachment_91253" align="aligncenter" width="580"] Source: MetalMiner data from MetalMiner IndX(™)[/caption]

Source: MetalMiner data from MetalMiner IndX(™)[/caption]

Shanghai Futures Exchange (SHFE) aluminum stocks fell in March for the first time in more than nine months. Decreasing stocks sometimes point to falling inventories of aluminum in China, the world’s biggest aluminum producer and consumer. SHFE stocks dropped by 154 tons in March, according to exchange data released at the beginning of April. However, SHFE aluminum stocks still stand at 970,233 tons.

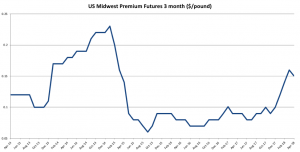

MW Aluminum Premiums

Meanwhile, U.S. Midwest aluminum premiums fell for the first time since November 2017. The $0.01/pound drop at the beginning of April comes after a sharp uptrend in the premium. Despite the lower premium this month, the pace of the increases may continue for some time.

What This Means for Industrial Buyers

LME aluminum price retracement may give buying organizations a good opportunity to buy, as prices may increase again.

However, as prices are currently trading lower, buying organizations may want to wait until the market shows a clearer direction. Therefore, adapting the “right” buying strategy becomes crucial to reducing risks.

Given the ongoing uncertainty around aluminum and aluminum products, buying organizations may want to take a free trial now to our Monthly Metal Buying Outlook.

Want to see an Aluminum Price forecast? Take a free trial!

Actual Aluminum Prices and Trends

Tag: L1

Copper MMI: LME Copper Prices Fall

The Copper MMI (Monthly Metals Index) traded lower again this month, falling two points to 85. The Copper MMI dropped to December 2017 levels, driven by falling LME copper prices.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

When looking at the long-term trend, copper prices have held above the dotted blue line since September 2016. Although prices dipped a bit below the blue dotted line at the end of March, the line represents the current copper floor. Prices falling below the dotted line could suggest a short-term price correction.

[caption id="attachment_91215" align="aligncenter" width="580"]

Meanwhile, trading volume appears to be about the same as last month, when selling volume appeared weak. As the selling volume remains weak, the downtrend seems more like a short-term price correction than a change of trend.

Buying organizations may want to closely follow copper prices in the coming month or read our Monthly Metal Outlook in order to anticipate copper price movements.

Copper Stocks and Supply

LME copper stocks currently stand at 324,900 tons, up by 13,075 tons since the start of 2017 and 85,500 tons since the start of 2016.

According to the International Copper Study Group (ICSG), the provisional 2017 refined copper deficit was 163,000 tons. The situation for 2018 will also depend on the supply side, as many of the largest copper mines have upcoming labor contract negotiations still pending.

On top of that, the Caserones copper mine in Chile announced a shutdown this month in order to replace a leaking pipe. However, this shutdown is only partial and may not have a big effect on copper production.

Copper Scrap

Both Chinese copper scrap prices and LME copper prices typically trade together. In March, Chinese copper scrap prices fell to $6,035/mt. LME prices also fell but remain in a long-term uptrend. The same is true for copper scrap.

[caption id="attachment_91216" align="aligncenter" width="580"]

The spread between Chinese scrap copper prices and LME copper seems to be wider than it was back in 2016 and 2017. A wider spread may boost scrap copper demand for the applications that it are suitable due to its lower price.

What This Means for Industrial Buyers

Copper prices are currently approaching December support (at $6,530/mt) levels, when prices last dipped during the bullish rally.

Buying organizations bought some volume then. As long as copper prices remain bullish, buying organizations may want to buy on the dips. For those who want to understand how to reduce risks, take a free trial now to the MetalMiner Monthly Outlook.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Copper Prices and Trends

India Looks for Section 232 Tariffs Exemptions

Unlike China, its neighbor India is not right now thinking on the lines of imposing retaliatory tariffs on U.S. products. However, the Indian government has requested the U.S. to exempt it from the hefty tariffs on steel and aluminum imports. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook This was revealed […]

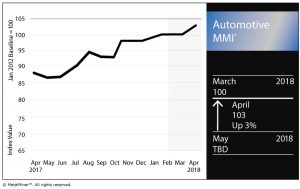

Automotive MMI: U.S. Auto Sales Rev Up for 6.3% Year-Over-Year Jump in March

The Automotive Monthly Metals Index (MMI) jumped three points for an April reading of 103 after a month that saw the U.S. impose Section 232 tariffs of 25% and 10% on steel and aluminum imports, respectively, in addition to escalating trade tensions between the U.S. and China.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

U.S. shredded scrap jumped 3.1%, while LME copper continued its 2018 cooling down, dropping 2.5% month over month.

Chinese primary lead jumped 1.3%.

U.S. Auto Sales

According to monthly sales data release by Autodata Corp, it was a strong month for several of the top automakers in the U.S. market.

General Motors posted a 15.7% increase in sales year over year, and is up 3.8% in the year to date compared with the same time frame last year.

Ford Motor Co. saw its sales jump 3.5% year over year in March, but remains down 2.7% in the year to date.

Fiat Chrysler’s March sales jumped 13.6% year over year, and boasts an 0.8% increase for the year to date. Toyota’s sales jumped 3.5% in March year over year and is up 7.4% in the year to date. Honda also had a good month, posting a year-over-year sales increase of 3.8%; however, its year-to-date sales are down 0.8%.

Volkswagen, Mitsubishi and Mazda continued what has been a strong 2018 for each of them. Volkswagen’s March sales rose 13.5% year over year, while the German automaker’s year-to-date sales are up 9.9%. Mitsubishi jumped 21.7% in March and is up 22.7% in the year to date. Mazda, meanwhile, posted a 35.7% increase in March and is up 21.6% in the year to date.

In total, vehicle sales in March were up 6.3% year over year and are up 1.9% in the year to date. American consumers continue to prize light trucks, as sales of those vehicles rose 16.3% year over year in March and are up 9.8% for the year to date.

U.S.-China Trade Tensions Rise

Earlier this week, the Office of the United States Trade Representative released a list of 1,300 Chinese products that could be hit with tariffs (stemming from the administration’s Section 301 probe of Chinese trade practices).

Not long after, China announced it would place 25% tariffs on 106 U.S. products, including autos, Reuters reported.

Tesla and Tariffs

It’s been a rough couple of weeks for Tesla.

In late March, the fatal crash of a Tesla Inc. Model X led to a massive selloff, leading to an 8.2% drop in its stock and its lowest closing in almost a year, CNBC reported.

On top of that, the electric vehicle (EV) maker continues to struggle with the cold, hard reality of production timelines. CNBC reported that Tesla missed its quarterly goal of producing 2,500 Model 3s per week.

The stock price recovered Tuesday, but Wednesday’s news of $50 billion in tariffs from China — in retaliation to the U.S.’s own recent announcement regarding a potential $50 billion in tariffs on Chinese imports — is another hit to the EV firm.

According to Bloomberg, China accounted for 17% of Tesla’s 2017 revenue.

Actual Metal Prices and Trends

A Battle Rages Between Two Rival London Black Cab Manufacturers

The fight is on in the streets of London between two rival manufacturers of the iconic London black cab. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Earlier this year the London High Court cleared an appeal made by the Chinese-owned London Electric Vehicle Company (LEVC) against British Metrocab that had […]

DRC Makes a Grab for a Larger Slice of the Pie

I guess you can’t blame countries like the Democratic Republic of Congo (DRC) for looking to acquire a bigger piece of the wealth from their own supplies of natural resources. Need buying strategies for steel in 2018? MetalMiner’s Annual Outlook has what you need The Telegraph reports that President Joseph Kabila is ripping up the […]

World Steel Association: February Global Crude Steel Production Up 3.5% Year Over Year

According to a World Steel Association report this week, global crude steel production in February was up 3.5% compared with February 2017. The 64 countries reporting to the World Steel Association produced 131.8 million tons in February, according to the report. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook China’s crude […]

U.S. Steel Imports Down 5.3% Year Over Year Through February

According to Census Bureau data reported by the American Iron and Steel Institute (AISI) last week, U.S. imports of steel were down 5.3% through the first two months of the year compared with the same time frame in 2017. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Total steel imports through […]

Are Those SHFE Stocks Telling Us the Whole Story?

The state sector has benefited better than most in China from Beijing’s environmental crackdown, which resulted in enforced closure of steel, aluminium, coke, alumina and coal-burning power plants. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook The extent to which the resulting rise in prices benefited domestic aluminum smelters was revealed […]

Shipping Rate Rises Pose a Risk to Trade

Back in 2016, after nearly 30 years of asking, the International Maritime Organization (IMO) — the U.N. body that polices the marine industry — finally succumbed to collective outrage and announced a change to take effect from 2020 leading to an effort to clean up ship pollution. Need buying strategies for steel? Try two free […]