The Raw Steels Monthly Metals Index (MMI) moved sideways from March to April, with a mere 0.65% increase. A sharp reversal to the downside for Midwest HRC future prices placed additional weight on the index. Meanwhile, HRC price action continued to the upside during the month, with the HRC rally yet to show a meaningful slowdown. […]

Tag: steel price index

Steel Prices and Global Market: a 2022 Review

Steel prices endured long-term declines throughout 2022. However, with so many geopolitical events and supply chain pinches, it is important to note that the market in general was quite volatile. Steel Prices: Q1 of 2022 Raw steels started the year with a huge bang, rising over 12% between January and February. China’s climate efforts caused […]

Raw Steels MMI: Where is the Bottom for Falling Steel Prices?

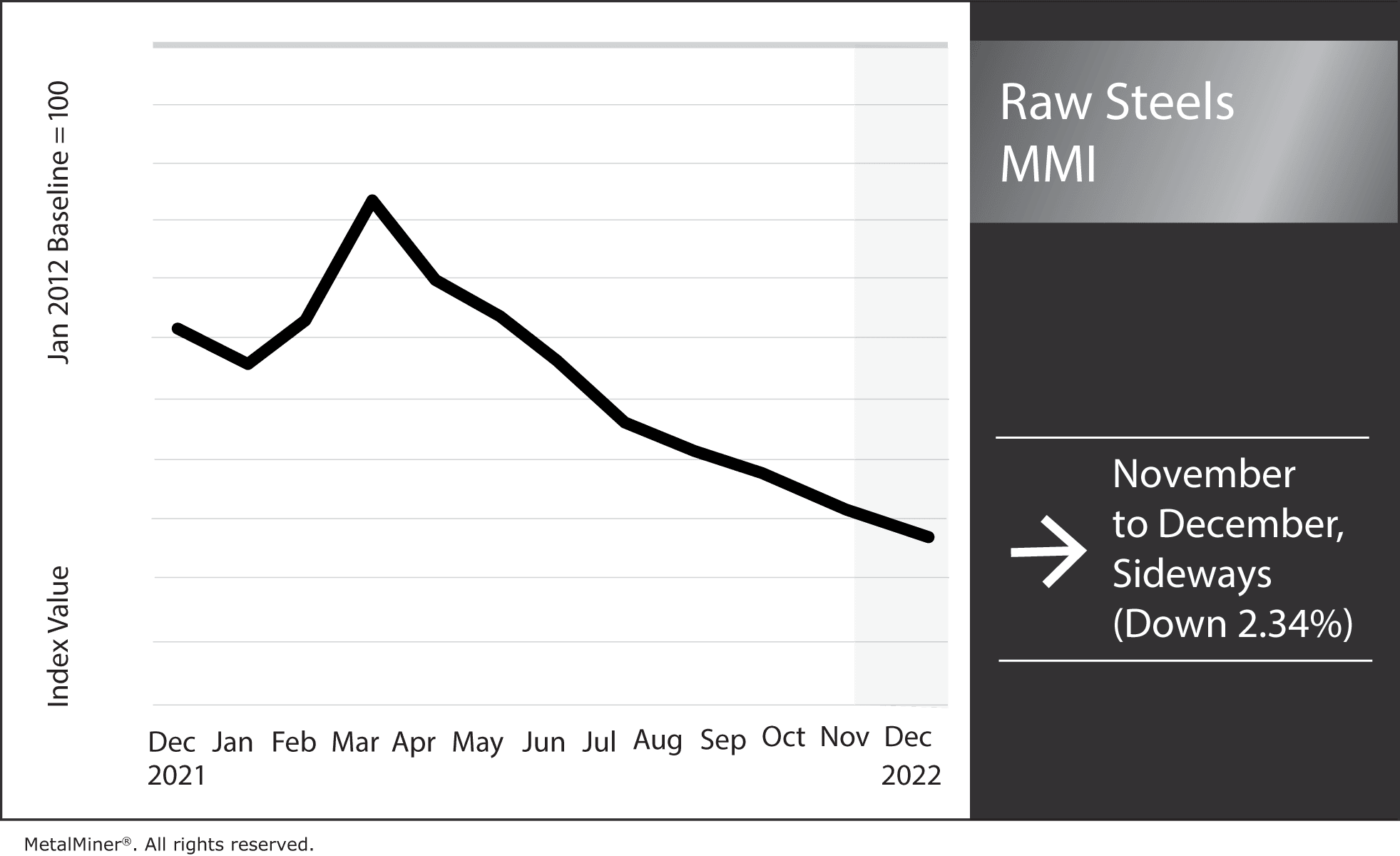

The Raw Steels Monthly Metals Index (MMI) fell by 2.34% from November to December. Ultimately, U.S. steel prices remain decidedly bearish. Meanwhile, hot rolled coil prices saw the most substantial decline, falling 12.6% month over month. Plate prices, on the other hand, mainly remained sideways but continued to edge slowly downward with a 2.9% decline. […]

Raw Steels MMI: Steel Price Downtrend Resumes While Plate Prices Hold Flat

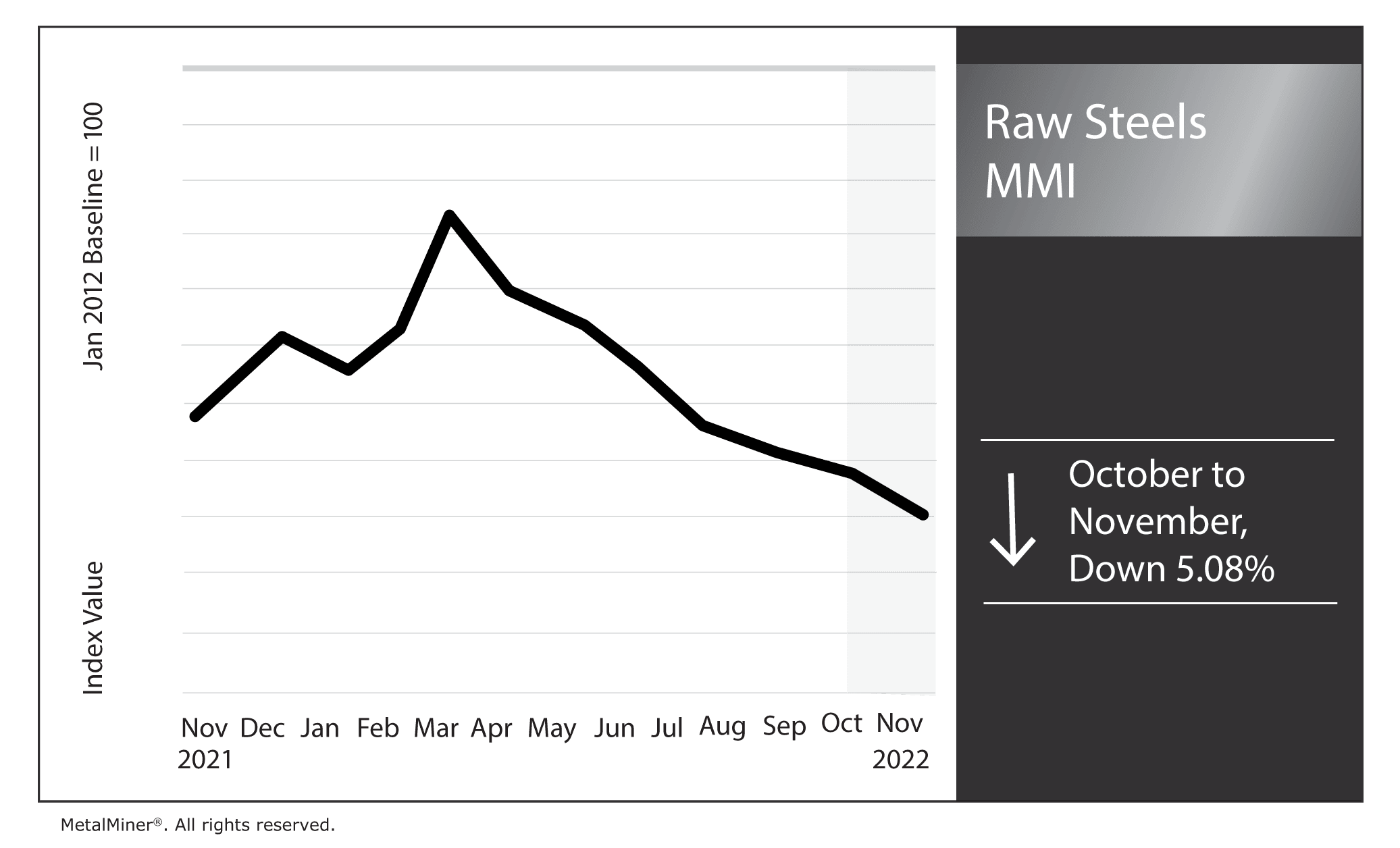

The Raw Steels Monthly Metals Index (MMI) fell by 5.08% from October to November. A number of factors played into steel prices dropping. After U.S. steel prices appeared to flatten, the descent for hot rolled coil, cold rolled coil, and hot dipped galvanized prices accelerated throughout October. Hot rolled coil prices now sit at their […]

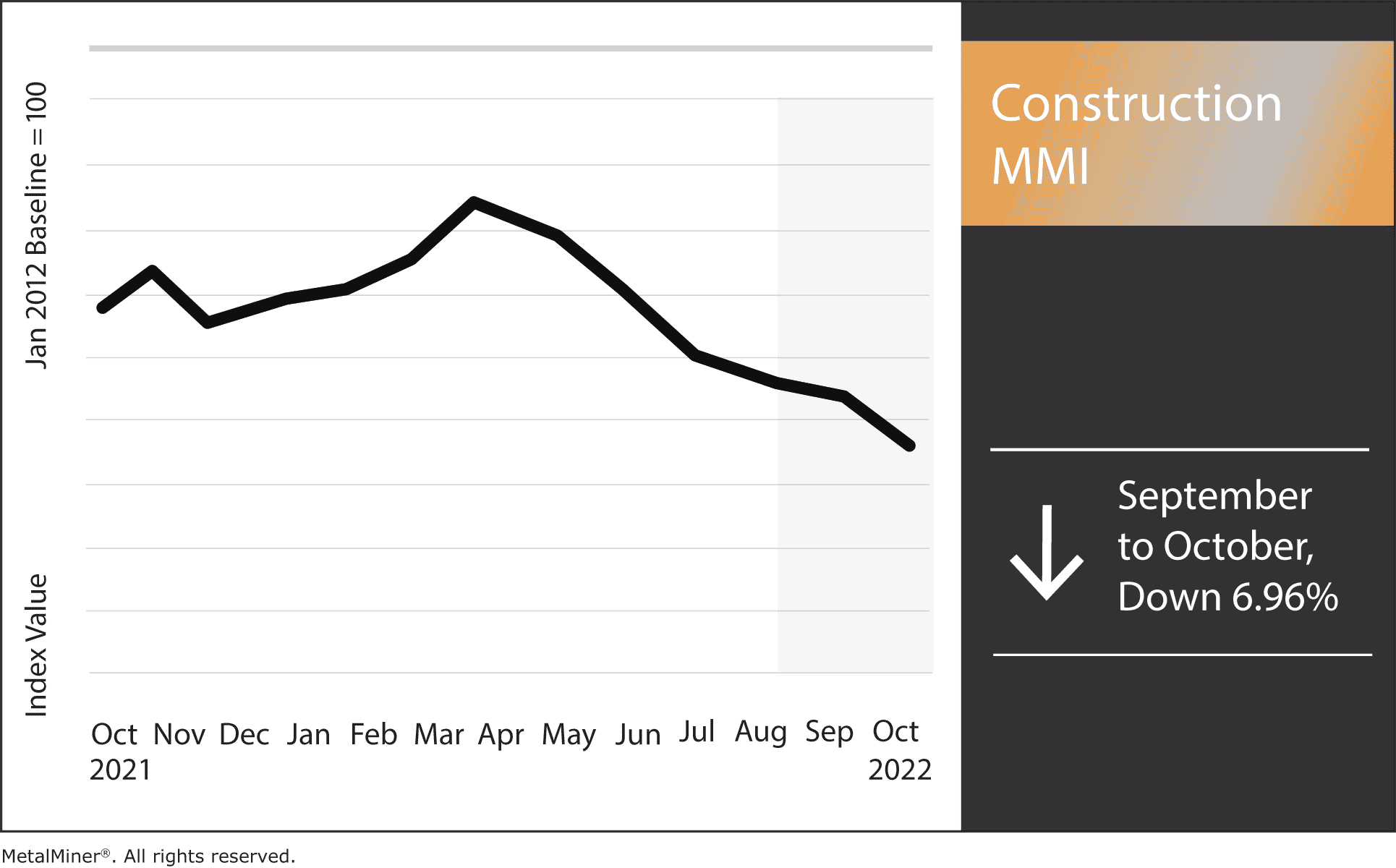

Construction MMI: High Interest Rates Haunt US Construction

The October Construction MMI (MetalMiner Monthly Index) dropped 6.96%. Not only did the construction cost index fall recently, but high interest rates have seriously impacted the US housing construction sector. Billings are on the rise in both the US commercial construction sector and on the consumer end. Meanwhile, new housing construction continues to cool due […]

Raw Steels MMI: Steel Prices Flatten, Slowly Edge Downward

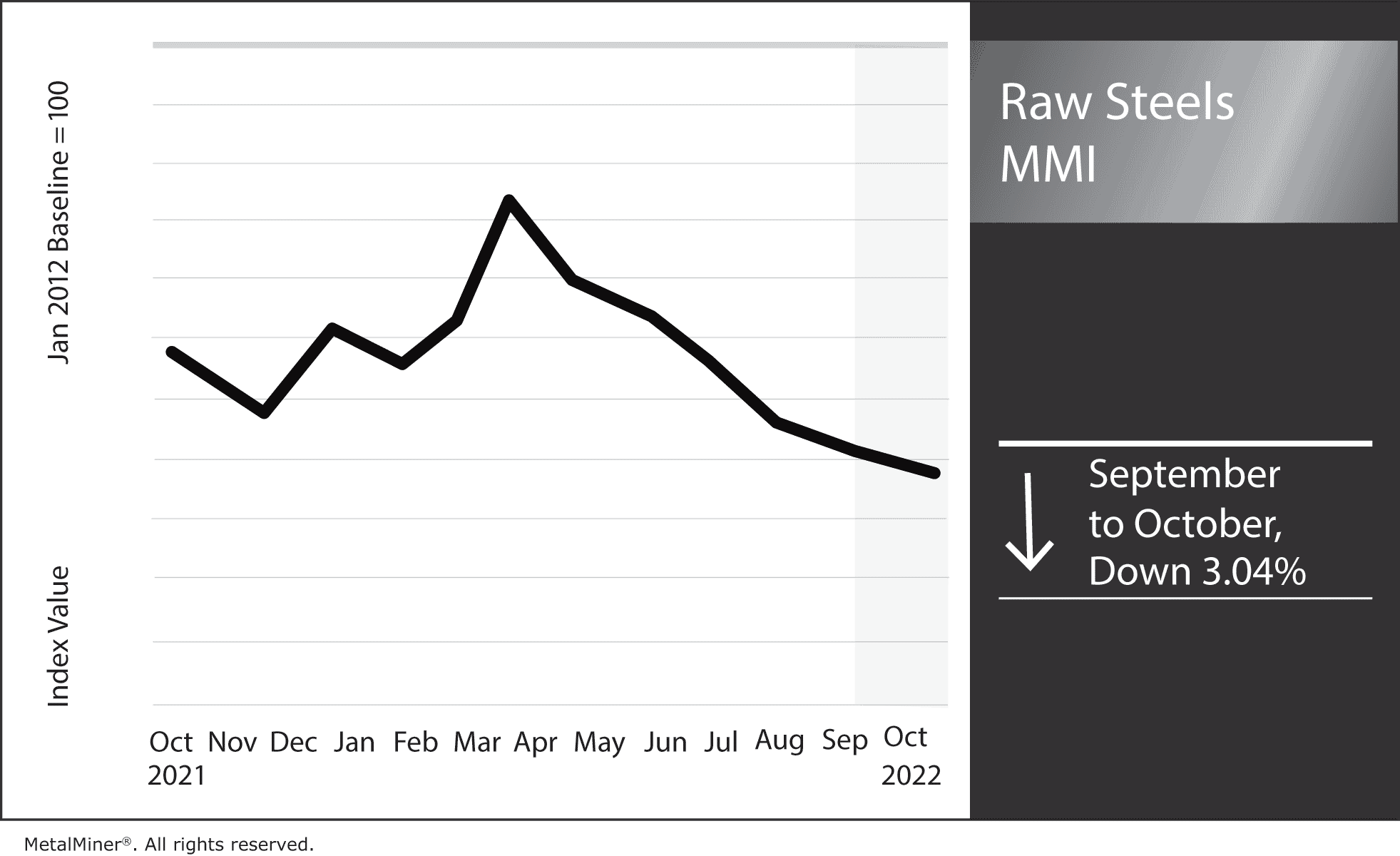

The Raw Steels Monthly Metals Index (MMI) fell by 3.04% from September to October. U.S. steel prices continued to drop throughout September. However, declines for both hot rolled coil prices and cold rolled coil prices slowed to a sideways trend. Plate prices, which have shown the most strength of steel prices, traded down for the […]

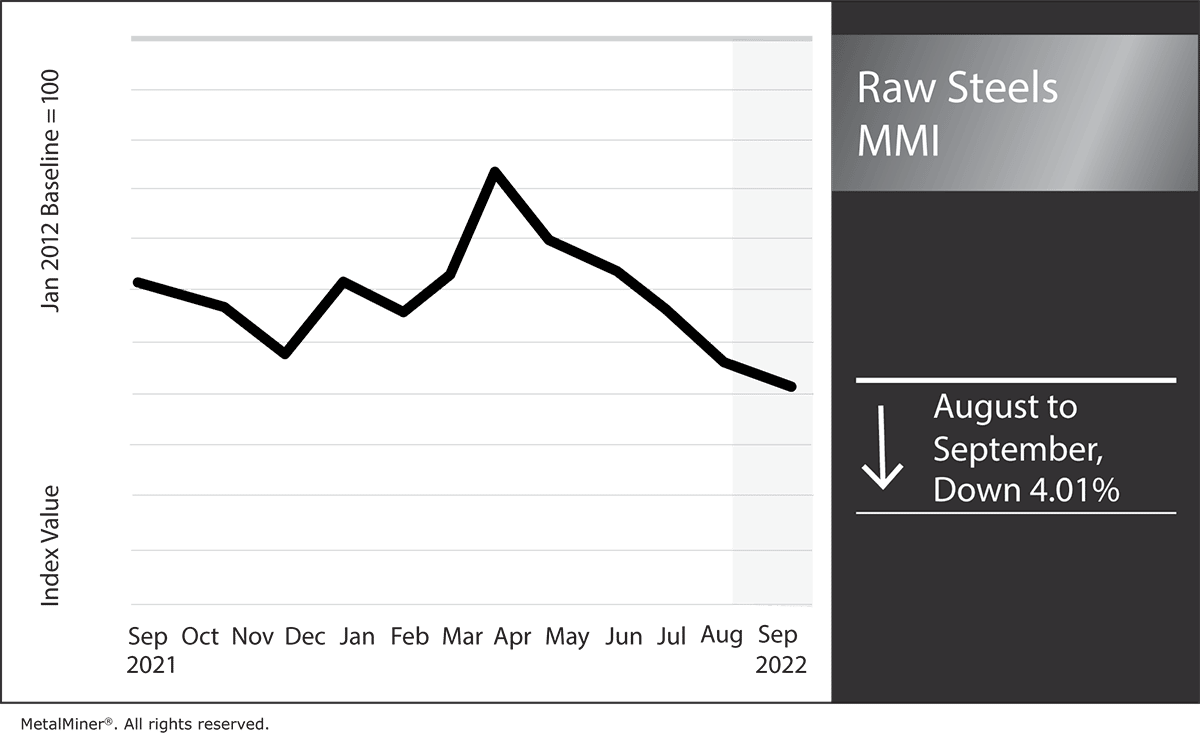

Raw Steels MMI: Steel Prices Decline, Pace Slows

U.S. steel prices continue to search for a bottom, although the pace of declines began to slow as August saw the smallest month-over-month percent decrease since May. Nonetheless, by early September, hot rolled coil prices fell beneath the $800/st mark for the first time since December 2020. Plate prices also trended downward last month, dipping […]

Automotive MMI: Downward Trend Continues, Experts Lose Confidence in the Automotive Market

The Automotive MMI (Monthly Metals Index) dropped by 6.32% this past month, a downward trend it has been maintaining since May. The drop comes despite valiant efforts to put out some of the fires plaguing the car manufacturing industry. But with the microchip shortage, surging inflation, and issues with both supply and demand, the automotive […]

Raw Steels MMI: Hot Rolled Coil Prices Hit New Lows

U.S. steel prices continued their decline this month alongside other steel markets. Hot rolled coil, cold rolled coil, and hot dipped galvanized prices all dropped beneath their early March bottoms. HRC prices, in particular, continue to close in on the $1,000/st mark, while plate prices saw their second consecutive month-over-month decline.The Raw Steels Monthly Metals […]

Renewable/GOES MMI: Renewable Prices Nose-Dive, GOES Remains Strong

The Renewables MMI (Monthly Metals Index) dropped significantly from June to July. All in all, the index fell a staggering 22.05%. How will this impact steel prices today? Problems With China’s Solar Panel Manufacturing Dominance Some experts say that initiatives aimed at creating a zero-carbon future are being impacted by dependence on Chinese solar panels. […]